Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

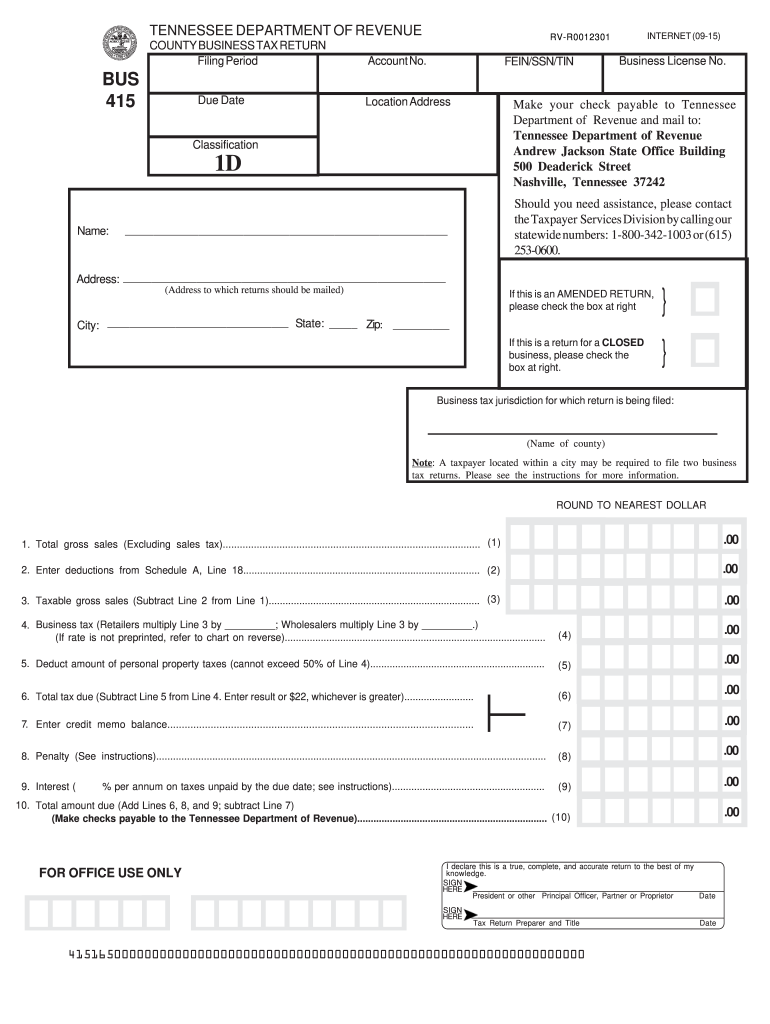

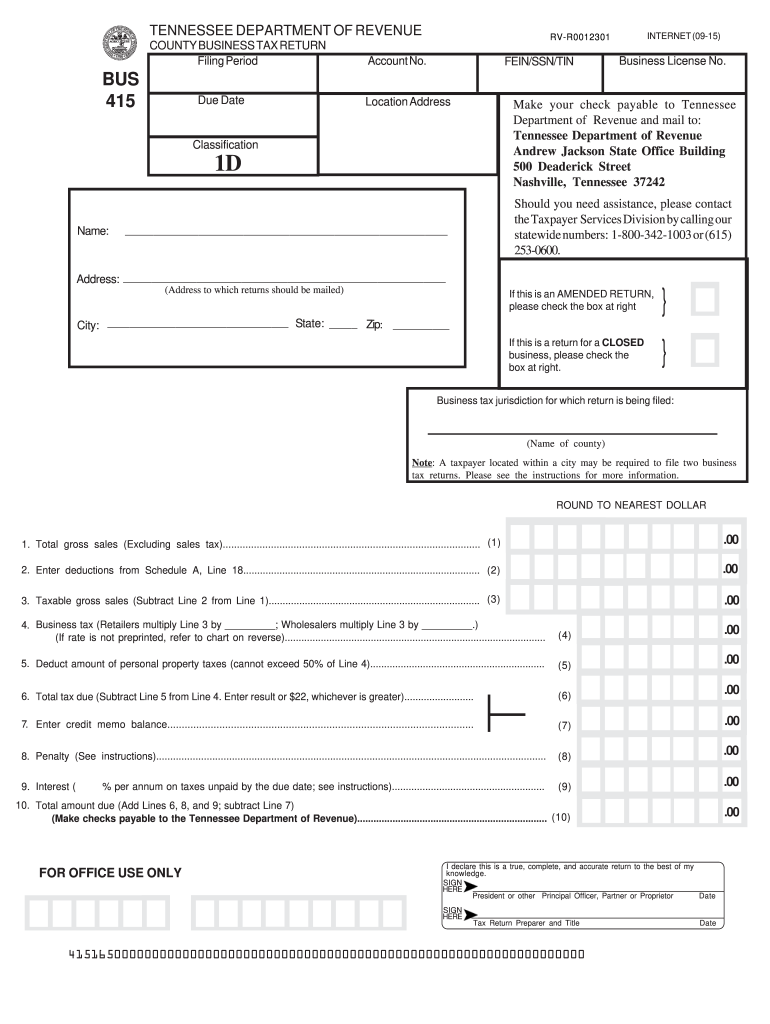

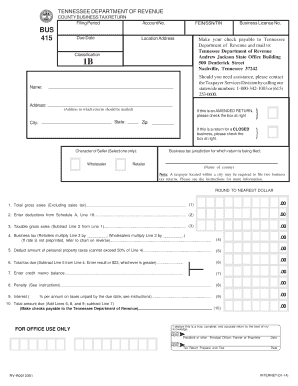

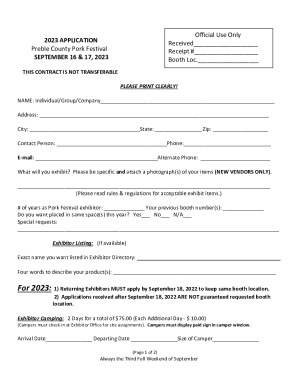

Tennessee form refers to the various legal and official documents used in the state of Tennessee. These forms are used for a wide range of purposes, including tax filing, business registration, real estate transactions, court filings, and many other legal and administrative functions. The specific content and format of Tennessee forms may vary depending on the purpose and the issuing authority.

Who is required to file tennessee form?

In Tennessee, individuals who are residents and have a federal filing requirement are also required to file the Tennessee Form Hall Income Tax Return (Form INC-220). This includes individuals who have income sourced from Tennessee, even if they are non-residents.

How to fill out tennessee form?

To accurately fill out a Tennessee form, follow these steps:

1. Obtain the correct form: Make sure you have the most up-to-date version of the specific form you need. The Tennessee state government website or relevant government agencies should have the forms available for download or print.

2. Read the instructions: Each form will have specific instructions indicating how to fill it out correctly. Go through these instructions thoroughly before starting the form.

3. Enter your personal information: Provide your full legal name, address, telephone number, and any other requested personal details as required. Ensure your information is accurate and current.

4. Complete the necessary sections: Different forms will have different sections that require information in specific formats. Fill in the applicable sections as required, ensuring accuracy and completeness. Examples of sections may include income, deductions, and dependents.

5. Use black ink: Fill out the form using black ink to ensure legibility. Avoid using pencil or other colors that may be difficult to read or scan.

6. Review for accuracy: Carefully review the completed form to ensure all the information provided is accurate and consistent. Double-check your entries to avoid mistakes or omissions.

7. Attach supporting documents: Some forms may require additional documentation to support your entries. Ensure all necessary documents are included before submitting the form.

8. Sign and date: Physically sign and date the form where indicated. Unsigned forms may be considered incomplete.

9. Make copies: Before submitting the form, make photocopies or scan a digital copy for your records. This will help to maintain a record of the information you submitted and provide a reference if needed in the future.

10. Submit the form: Send the completed form, along with any required attachments or fees, to the address provided in the instructions. Check for any specific submission instructions, such as submitting online, mailing, or delivering in person.

It's important to note that if you have any doubts or challenges while filling out the form, it is advisable to seek professional assistance or consult with a tax advisor or legal expert for guidance.

What information must be reported on tennessee form?

In order to accurately complete the Tennessee Form, you need to include the following information:

1. Personal Information: Your full name, address, Social Security number, and the tax year for which you are filing.

2. Filing Status: Indicate whether you are filing as single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

3. Income Details: You will need to report all sources of income including wages, salaries, tips, self-employment income, rental income, interest, dividends, capital gains, retirement income, and any other taxable income.

4. Deductions and Credits: Include all applicable deductions and credits such as standard deduction or itemized deductions, education expenses, child tax credit, elderly or disabled credit, nonrefundable credits, etc.

5. Tennessee-Specific Information: Some additional information required specifically for Tennessee may include any Tennessee specific deductions or credits like the Hall income tax credit or any other state-specific tax credits or incentives.

6. Withholding and Estimated Payments: Report any taxes withheld from your income, both federal and state. Also, include any estimated tax payments made during the year.

7. Health Insurance: You may need to provide information regarding your health insurance coverage to comply with the Shared Responsibility Payment (Individual Mandate) if applicable.

8. Supporting Documents: Attach any necessary supporting documents like W-2s, 1099 forms, and any other relevant tax forms or schedules.

Note that this is a general overview, and the specific requirements may vary depending on your individual circumstances. It is always advisable to consult the official instructions provided with the Tennessee tax form or seek assistance from a tax professional to ensure accurate reporting.

What is the penalty for the late filing of tennessee form?

The penalty for the late filing of a Tennessee form depends on the specific type of form and the reason for the late filing. In general, Tennessee imposes a penalty of 5% per month (or fraction thereof) on any unpaid tax liability, with a maximum penalty of 25%. Additionally, there may be interest charges on any unpaid tax amounts. However, penalty and interest amounts can vary, so it is important to consult the specific instructions and guidelines provided by the Tennessee Department of Revenue for the particular form being filed.

How do I make edits in bus 415 form tennessee without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing fillable 415 download form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I edit tennessee form fillable on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing tennessee tax form bus 415 right away.

Can I edit tennessee form bus 415 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share county business tax return form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!